Climate risks and opportunities – scenarios inform Cargotec’s strategic direction

15/11/2021

Climate change is expected to have an increasing strategic and financial impact on businesses. To ensure strategic relevance, Cargotec has used scenario analysis to outline the most pressing climate-related risks and opportunities.

AUTHOR: ALISA KNUUTINEN

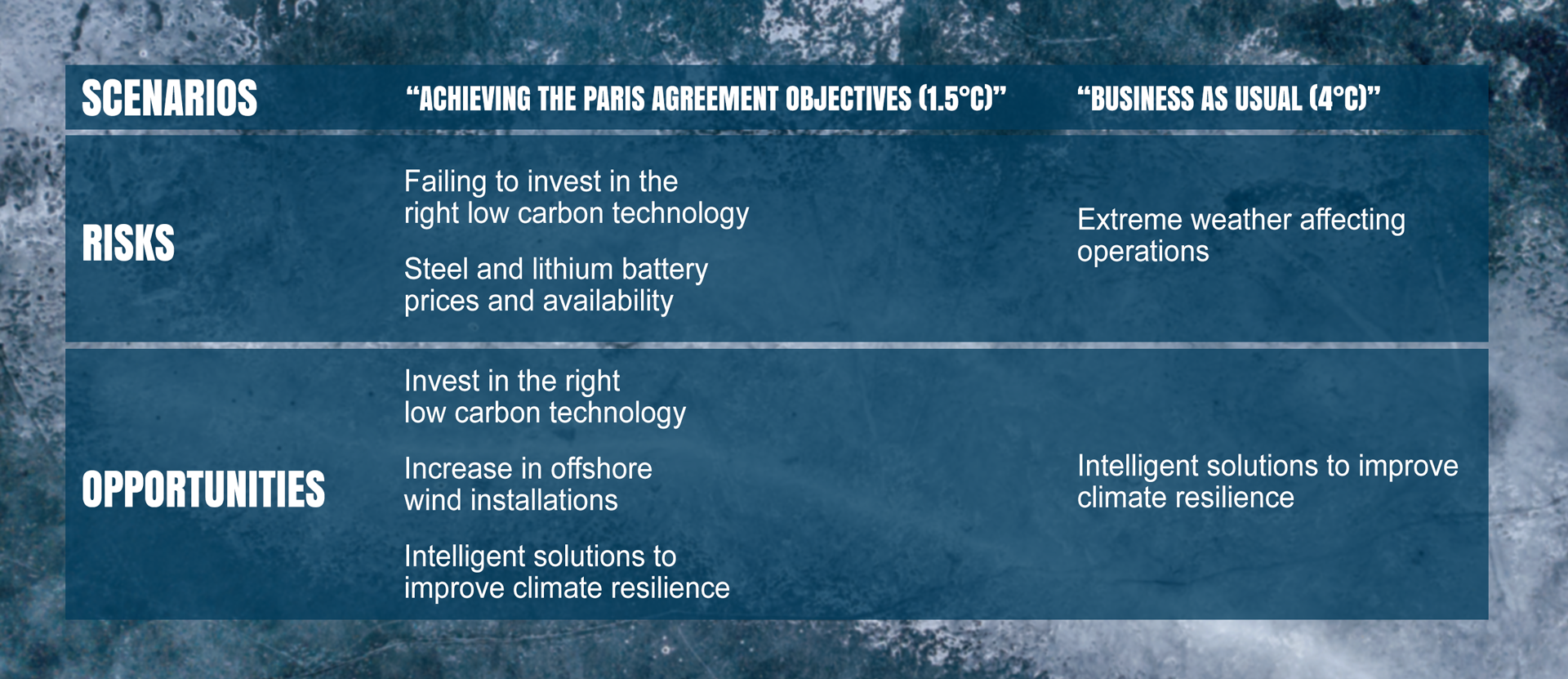

Cargotec has committed to the United Nations’ Business Ambition to limit global temperature rise to 1.5°C. Aligned with this, climate is at the heart of our refined strategy. To test strategic resilience, we analysed how climate change may impact our operations and value chain. We conducted scenario analysis depicting two possible futures - one in which we manage to limit global warming to 1.5 degrees and another one where the temperature rises 4 degrees*.

Let’s dive deeper into these alternative futures and their strategic and financial impact.

Achieving the objectives of the Paris agreement (1.5 °C) scenario provides business opportunities

In this scenario, the world achieves the objectives of the Paris Agreement and manages to limit global warming to 1.5 degrees. Climate policy ambition strengthens and global CO2-emissions start declining fast. High carbon prices are introduced in most economies and global power is mostly generated using renewables. Customers are increasingly climate-conscious and require more from companies. Governments and private investors prefer ”green companies.” This presents the following intertwined risks and opportunities for us:

INVESTING IN THE RIGHT LOW CARBON TECHNOLOGY

Description: Sustainable technologies are evolving and maturing rapidly but for now there are no clear winners defined. Hydrogen fuel cells hold potential to play a role in the decarbonization of the transport sector, but electricity is expected to become the main carrier of final energy in port operations.

Impact on Cargotec: Cargotec’s customers face heavy pressure to reduce their CO2 emissions. Our sustainable technology focus is on electrification, hybrid technology and automation. There's a potential of increased revenues resulting from increased demand for eco efficient products and services. On the contrary, failing to invest in the right technology can result in increased indirect costs if the R&D investments would not be realised.

INTELLIGENT SOLUTIONS TO IMPROVE CLIMATE RESISTANCE

Description: Physical risks related to climate change are already present and increasing globally. There will be a need for adaptation and resiliency solutions. Automation, robotisation, digitalisation and remote services remove the need to be physically present, improving customers’ climate resilience.

Impact on Cargotec: We are well positioned to develop intelligent solutions to improve climate resilience of customers' operations, which result in increased revenues from climate adaptation and resilience solutions.

STEEL AND LITHIUM BATTERY PRICES AND AVAILABILITY

Description: Steel prices may increase due to more aggressive CO2 taxation or more expensive production of low emission alternatives. The demand for lithium batteries is expected to increase as a result of the electrification trend.

Impact on Cargotec: Purchased steel structures are the biggest source of Cargotec's supply chain emissions. Due to our strategic focus on electrification, lithium batteries are also of high importance for us. Potential steel and lithium battery price increases and volatility, as well as possible limited availability, can impact our raw materials and indirect costs.

INCREASE IN OFFSHORE WIND INSTALLATIONS

Description: Wind power generation is estimated to increase by 740% between 2020 and 2055. Offshore wind is a small but rapidly growing energy source. The share of offshore wind in total wind electricity generation is expected to total 40% in 2050, 15% of which is floating offshore. The EU's target to increase the share of renewable energy to 40% of final consumption by 2030 is making this a large opportunity.

Impact on Cargotec: MacGregor’s offshore division already provides many solutions including mooring of floating wind turbines, 3D compensated cranes for installations and equipment for offshore wind service vessels. We can expect growth in this area as the overall share of wind power increases. Accessing new and emerging markets can result in revenue increases.

Business as usual (4ºC) -scenario increases physical risks

In this scenario, the world continues business as usual and global warming rises to 4 degrees. Physical climate risks increase due to a lack of coordinated climate policy action. Economic growth is preferred over climate action, population grows fast and overconsumption of resources continues. The world continues to be dependent on fossil fuels and there is limited low-carbon technology deployment. Improvements to energy intensity are modest and customers are not prioritizing climate in their decision making. This presents the following risk and opportunity:

EXTREME WEATHER AFFECTING OPERATIONS

Description: Intensity and frequency of extreme weather events are expected to increase. Daily precipitation events are projected to intensify by 7% for each 1°C of global warming. Intense tropical cyclones and peak wind speeds of tropical cyclones are projected to increase, while different geographical areas are exposed to different kinds of physical risks.

Impact on Cargotec: A major weather event in one region may impact our suppliers, causing delays that trickle down. This might cause significant delays and compromise timely delivery to clients. Also the physical safety of our employees can be in danger. Business continuity plans are essential to mitigate these risks.

INTELLIGENT SOLUTIONS TO CLIMATE RESILIENCE

Description: Operating conditions are severely challenged by extreme climate conditions and pandemics. As a result, there's an even greater need for intelligent solutions that improve customers’ climate resistance.

Impact on Cargotec: Developing new products and services to enable customers' operations in more challenging circumstances is a business opportunity for Cargotec. For instance, by automating port operations Cargotec can eliminate safety risks and ensure business continuity under social distancing.

Conclusion

Cargotec’s refined strategy has been informed by these climate risks and opportunities. We will continue innovating energy efficient and climate resilient solutions and seek to mitigate the risks in our supply chain and own operations. We believe that all of this will take us a little closer to our vision to become a global leader in sustainable cargo flow.

*Scenario analysis background:

The 2 degree scenario follows the carbon emission pathway RCP 2.6 of the IPCC 5th Assessment report (SSP1-2.6 of the IPCC 6th Assessment Report) and the Sustainable Development Scenario and complementing Net Zero Emissions by 2050 analysis as described in the IEA World Energy Outlook 2020.

The 4 degree scenario is based on the IPCC RCP 8.5 carbon emissions pathway where global emissions continue to grow, and

Scenario work covers Cargotec's short-, medium- and long-term time-horizons. Cargotec considers time horizons of less than one year as short-term, 1-3 years as medium-term and 3-30 years as long-term.