Why did operating profit excluding restructuring costs decrease by 20%?

Kalmar’s operating profit excluding restructuring costs decreased due to a less favorable business mix. Hiab’s operating profit declined due to weakening of US dollar compared to euro as well as investments in sales and service capabilities and digitalisation. MacGregor’s operating profit excluding restructuring costs decreased compared to the comparison period, as cost savings and a more favorable sales mix did not fully compensate the decline in sales.

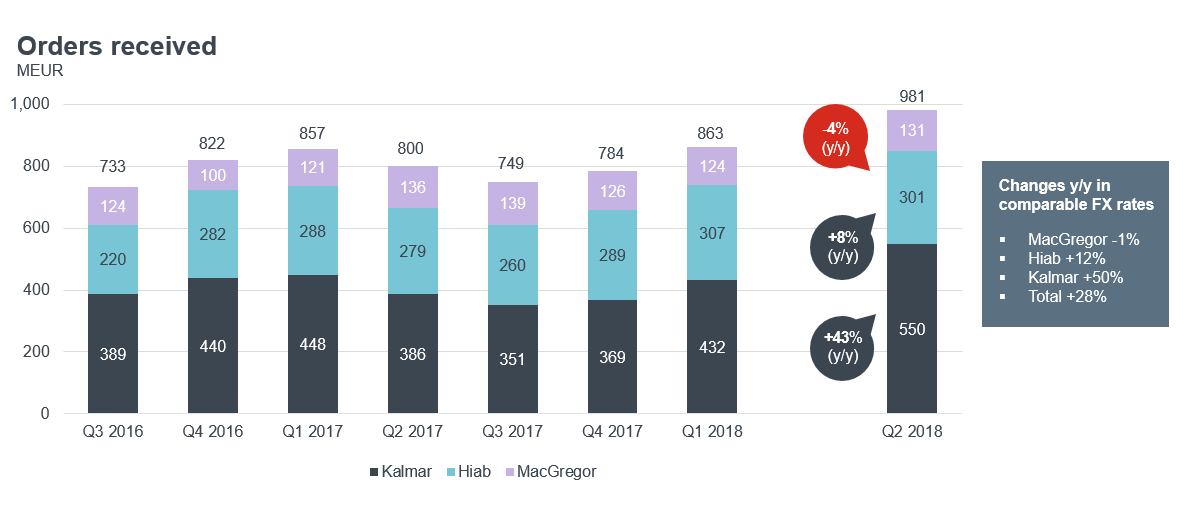

Orders received increased by 23 percent.

How did order intake develop in Q2?

Increase in Kalmar (43%) and Hiab (8%), decline in MacGregor (-4%). Total orders grew by 23% (+28% in comparable FX). Service orders increased by 16%. One of the highlights during this quarter was Kalmar’s agreement to deliver an advanced automation solution to Sydney, Australia, valued at approximately 80 million euros.

How was the development in services in Q2?

Serviced orders received grew 16%, highest growth rate was in Kalmar.

Service sales grew 5% (+9% at comparable currencies), growth in all business areas.

What was included in restructuring costs?

Restructuring costs amounted to EUR 34.9 million. The biggest item was non-cash 30meur impairment loss related to RHI revaluation. We also recognised a sales gain of EUR 12.9 million related to Siwertell divestment and a sales loss of EUR 4.7 million related to divestment of Kalmar Rough Terrain Center (KRTC).

Cargotec YTD June 2018 operating profit excl. restructuring costs is EUR 113.2 million, which is 13% behind H1 2017. What are the key possibilities to improve EBIT in 2018?

Firstly, in the beginning of the year we have been suffering from the supply chain bottlenecks. Those are gradually improving. Secondly, our order intake in Kalmar mobile equipment and in services was on a good level in H1/18, supporting our sales in the second half of 2018. Thirdly, some projects in Kalmar and MacGregor generate more revenues in the second half than in the first half of the year. Fourthly, currency headwind impact will be lower in the second half, based on current exchange rates.

Why software sales declined so much in Q2?

We had one larger license transaction in Q2/17. Furthermore, we get some headwind from the USD weakness and automation software sales declined.

How are the supply chain challenges developing?

The upstream (component supplier) situation has been continuously stabilizing. For example in Hiab we have been able to reduce the lead times. Both in Kalmar and Hiab we are running the operations at high capacity and have still some bottlenecks in the downstream deliveries, like installation capacity.

How much was the weak USD impact on Hiab’s operating profit in H1 2018?

It was around EUR 5 million in Q2 and EUR 12 million in Jan-Jun 2018, which is line with our earlier estimate for full year impact of 20-25 million eur.

Why was the cash flow so weak in H1 2018?

Cash flow decreased, as more capital was tied up in inventories due to improved demand in certain product categories in Kalmar and Hiab as well as supply chain issues, and as MacGregor’s advances received were lower due to low orders received.

January-June 2018 half year financial report in brief

Hanna-Maria Heikkinen, Vice President, Investor Relations, presents Cargotec's Q2 2018 results.